Meta Description: Centralized exchanges (CEX) offer high liquidity, advanced trading tools, and customer support. Learn how CEX platforms work, their pros and cons, and how to choose the best one in the USA and Canada.

Introduction

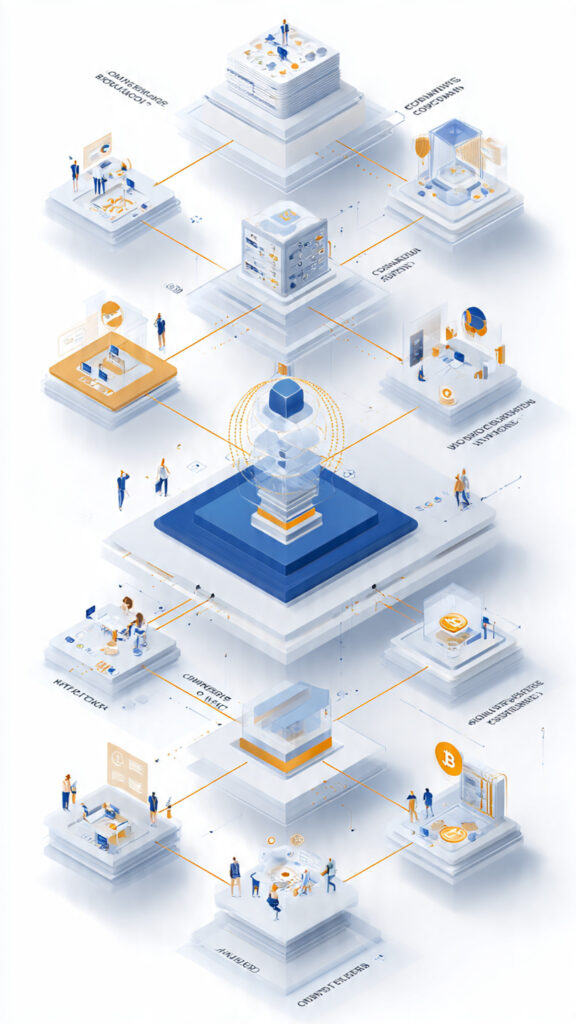

Centralized exchanges, commonly known as CEX, remain the backbone of the cryptocurrency trading ecosystem. Despite the rise of decentralized finance (DeFi) and non-custodial platforms, the majority of crypto trading volume still flows through centralized exchanges.

Why? Because CEX platforms offer something most users value: high liquidity, advanced trading tools, ease of use, and customer support. For beginners and professional traders alike, centralized exchanges act as the primary gateway into the crypto market.

This article provides a clear, evergreen explanation of what centralized exchanges are, how they work, their advantages and risks, and why they continue to dominate crypto trading in the USA and Canada.

What Is a Centralized Exchange (CEX)?

A centralized exchange is a cryptocurrency trading platform operated by a company that acts as an intermediary between buyers and sellers. Users deposit funds into the exchange, and the platform manages custody, order matching, and transaction execution.

Unlike decentralized exchanges (DEX), a CEX controls:

- User accounts

- Order books

- Custody of funds

- Compliance and security systems

Examples of centralized exchanges include platforms widely used in North America, though the defining feature is not the brand—it is the centralized operational model.

SEO-relevant queries:

- what is a centralized crypto exchange

- how centralized exchanges work

- CEX meaning in crypto

How Centralized Exchanges Work

Centralized exchanges operate similarly to traditional stock exchanges, with some crypto-specific differences.

Account Creation and KYC

Most CEX platforms require users to create an account and complete Know Your Customer (KYC) verification. This process is especially strict in the USA and Canada due to regulatory requirements.

Custodial Wallets

When users deposit crypto or fiat, the exchange holds those funds in custodial wallets. This allows for fast trading but means users do not control their private keys.

Order Matching Engine

CEX platforms use high-speed order matching engines that pair buy and sell orders using order books. This enables:

- Market orders

- Limit orders

- Stop-loss and take-profit orders

This infrastructure is a key reason centralized exchanges offer superior liquidity and execution speed.

Why Centralized Exchanges Offer High Liquidity

Liquidity refers to how easily an asset can be bought or sold without affecting its price. Centralized exchanges typically offer the highest liquidity in the crypto market.

Reasons include:

- Large user bases

- Institutional participation

- Market makers providing constant liquidity

- Aggregated global trading volume

High liquidity results in:

- Tighter spreads

- Faster execution

- Reduced slippage

Long-tail keywords:

- why centralized exchanges have high liquidity

- crypto exchange liquidity explained

- best high liquidity crypto exchanges

Advanced Trading Tools Available on CEX Platforms

One of the strongest advantages of centralized exchanges is access to professional trading tools.

Common Features

- Advanced charting (indicators, timeframes, overlays)

- Margin trading and leverage

- Futures and perpetual contracts

- API access for automated trading

- Portfolio tracking

These tools make CEX platforms attractive to active traders, institutions, and algorithmic strategies.

In contrast, most decentralized exchanges still lack comparable depth and sophistication.

Customer Support: A Key Differentiator

Customer support is often overlooked until something goes wrong. Centralized exchanges typically provide:

- Ticket-based support systems

- Live chat (on major platforms)

- Account recovery processes

- Transaction dispute handling

For users in the USA and Canada, access to structured support is a major reason CEX platforms remain popular, especially among newcomers.

SEO phrases addressed:

- crypto exchange customer support

- safe crypto exchanges for beginners

- centralized vs decentralized exchange support

Regulatory Compliance in USA and Canada

Centralized exchanges operating in North America must comply with strict regulations, including:

- Anti-money laundering (AML) laws

- Know Your Customer (KYC) requirements

- Reporting obligations

- Consumer protection standards

While compliance adds friction, it also increases trust and legitimacy.

For many users, regulated CEX platforms feel safer than unregulated alternatives, especially when dealing with fiat currency.

Risks of Using Centralized Exchanges

Despite their advantages, centralized exchanges are not risk-free.

Custodial Risk

Because the exchange controls private keys, users rely on the platform’s security practices. History shows that poor security or mismanagement can lead to losses.

Regulatory Risk

Changes in regulation can impact services, asset listings, or user access—particularly in the USA.

Counterparty Risk

Users must trust that the exchange is solvent and operating transparently.

These risks highlight the importance of choosing reputable platforms and not storing long-term holdings on exchanges.

Long-tail keywords:

- risks of centralized crypto exchanges

- are centralized exchanges safe

- custodial risk crypto explained

Centralized Exchanges vs Decentralized Exchanges

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Custody | Exchange-controlled | User-controlled |

| Liquidity | High | Variable |

| Trading Tools | Advanced | Limited |

| Customer Support | Yes | No |

| Ease of Use | Beginner-friendly | Requires technical knowledge |

This comparison explains why many users start with CEX platforms and later explore DEX options as they gain experience.

Who Should Use Centralized Exchanges?

Centralized exchanges are best suited for:

- Beginners entering crypto for the first time

- Traders requiring high liquidity

- Users who trade frequently

- Investors using fiat on-ramps

- Institutions and professional traders

For long-term self-custody and DeFi use, other solutions may complement—but not fully replace—CEX platforms.

How to Choose the Right Centralized Exchange

When selecting a centralized exchange in the USA or Canada, consider:

- Regulatory compliance

- Security history

- Liquidity and trading volume

- Available trading tools

- Fee structure

- Customer support quality

Avoid choosing platforms solely based on marketing or incentives.

SEO-friendly queries:

- how to choose a centralized crypto exchange

- best CEX platforms USA

- crypto exchange selection guide

Why Centralized Exchanges Remain Relevant

Despite constant innovation in decentralized finance, centralized exchanges continue to dominate crypto trading volume. Their combination of liquidity, usability, advanced tools, and support remains unmatched for many use cases.

Rather than being replaced, CEX platforms are evolving—integrating compliance, improving transparency, and expanding services.

Conclusion

Centralized exchanges (CEX) play a critical role in the cryptocurrency ecosystem. By offering high liquidity, advanced trading tools, and customer support, they provide an accessible and efficient entry point for users in the USA and Canada.

While they come with custodial and regulatory risks, their benefits make them indispensable for many traders and investors. Understanding how CEX platforms work—and when to use them—is essential for navigating the crypto market responsibly.

As the industry matures, centralized exchanges are likely to remain a foundational pillar of crypto trading, not a temporary solution.